Market Commentary by Vine Group

- SQ Marketing

- Aug 4, 2023

- 4 min read

What next? Navigating the current rate environment & strategically preparing for the future

The recent increase by the Bank of Canada in early July, bringing rates to 5.00%, marks the steepest rate-hike cycle in history. Understandably, this has raised significant concerns among borrowers.

Some good news for borrowers is that light is starting to flicker at the end of the mortgage rate tunnel. Bank of Canada (BOC) decisions are predominantly driven by data, which often consists of trailing or lagging indicators. These indicators reflect past events and developments. The challenge with lagging indicators is that the BOC always forecasts ahead based on data trends and makes decisions that they hope will influence future data. If BOC increases rates too quickly, then it could have the unintended consequence of creating a “hard landing” and having a negative impact on the economy. If the BOC doesn’t increase rates quickly enough, it could give way to runaway inflation which is even worse.

Some of the key pieces of data that the BOC is constantly monitoring:

GDP growth

Unemployment

CPI (Inflation)

GDP Growth

This measure gives us a glimpse of the health of the economy. Current data shows that the economy grew by 0.30% for May, which was lower than expected by Stats Canada, which means annualized growth is at 1.00% total. Expectations for June are that GDP contracted by 0.20%, so the economy is certainly slowing down.

Unemployment

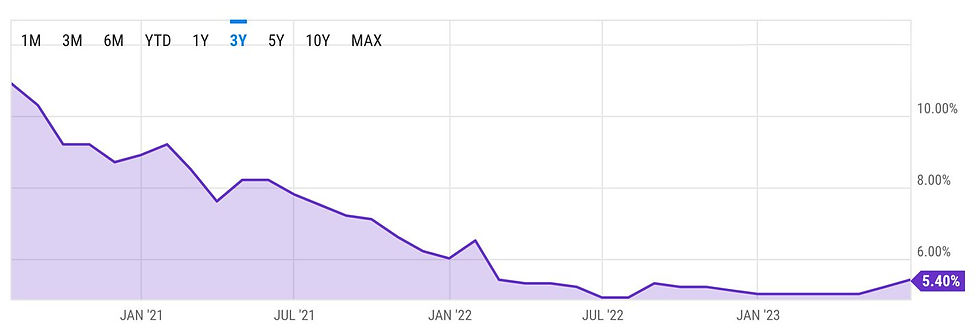

This measure gives us an idea of the % of unemployed persons in the labour force. When unemployment is too low, it can create inflation, so a rise in unemployment can be a positive sign in the current environment. Canada’s unemployment (currently 5.40% as of June 2023) has been slowly rising since May 2023 after stagnating at 5.00% for almost 6 months which has been a positive sign that rate increases have had their intended effect.

CPI (Inflation)

One of the most important indicators measures the average price change for a market basket of consumer goods.

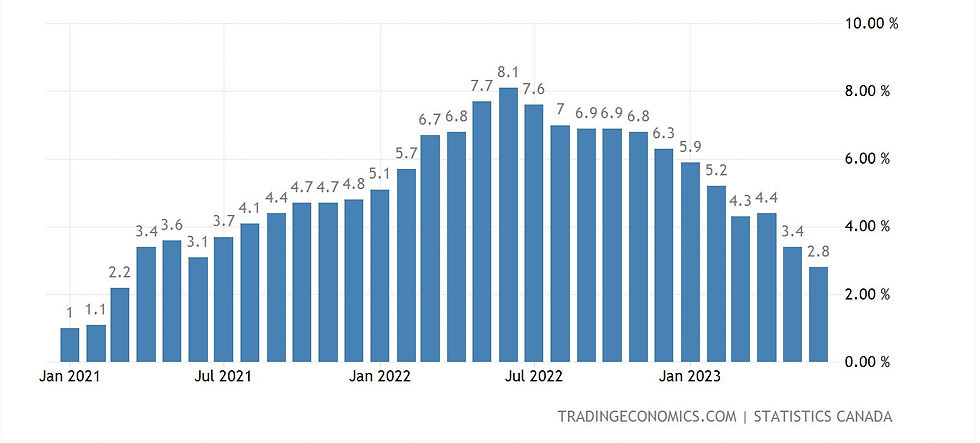

At its peak in the last 2 years, inflation hit over 8%, and in the most recent release, is currently sitting at 2.80%. Note that the Bank of Canada targets an inflation range between 2-3% as “ideal,” so the most recent decrease to 2.80% is a positive milestone. The challenge that many economists see is that “core inflation” is much “stickier” in slowing down. Core inflation excludes the more volatile goods and energy sectors and is typically seen as a more accurate representation of inflation. Currently, it sits at 3.80%, which is above the BOC’s target range, and some economists see an uphill battle to get this below the 3% threshold.

In looking at the data trends, the positive news here is that we’re finally seeing the intended effects of the rate increases in these data sets, and if we continue to see a trend, we’ve likely seen the end of rate increases.

The September 6th BOC announcement will be key in understanding where the direction of rates could go into the remainder of the year, as we have a fresh set of data to consider.

Economics Forecasts

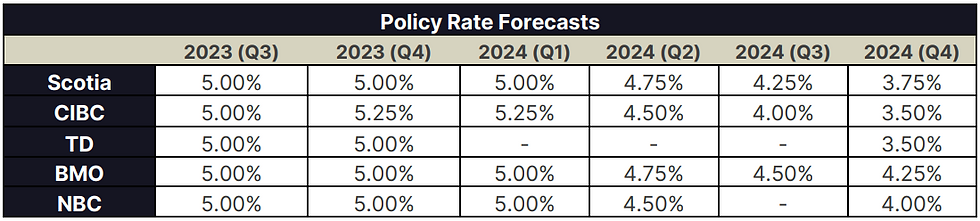

Economic forecasts are an excellent tool to understand where rates could end up. These should be reviewed with caution as data changes very quickly, but it is very helpful in attempting to predict what type of mortgage to consider.

On average, most big bank economists predict rates to decrease between 1.00-1.50% from where we are today. Currently, the overnight rate is at 5.00%, and Prime is at 7.20% for most banks. A rate decrease would be a huge break for variable-rate mortgage holders.

How to position yourself today when looking at a new mortgage or upcoming renewal

For some clients, considering a 1-year fixed rate might be the best option, assuming, based on the data, that rates will come down in the second half of 2024. Current 1- year fixed rates are higher than longer terms but allow the opportunity to renegotiate when rates ultimately come down in late 2024.

For the more risk-averse, a longer term 2 to 3-year fixed rate would be ideal to help lock in rates and monthly payments. 3-year terms are currently better priced but note that they come with a large penalty if you decide to break.

Consider a 5-year variable/adjustable rate. With rates nearing the top of the market, variable rates are likely to make a comeback. If you can get a very attractive discount on a variable rate, this might be the way to go and enjoy the benefit of rate decreases over the next few years.

Convert to fixed. If you have a variable/adjustable rate with a short time to maturity (say, 1-2 years), consider asking about converting to a short-term fixed rate to hedge against future increases. Many lenders allow this option without a penalty or a new application to be completed.

Consider a HELOC. HELOCs are often used to fund renovations, investments and for emergencies, but they can also be used to carry your traditional mortgage balance. Instead of borrowing with a mortgage on a fixed or variable term, a HELOC allows you to have a fully open, interest-only option. This means that although your payments are adjustable (linked to Prime), you will only have to make minimum monthly interest payments which could allow you to increase cash flow significantly.

The next Bank of Canada announcement is scheduled for September 6, 2023.

A financial review is key to ensuring you can navigate the current climate. Let’s chat and see how I can help.

We’re all in this together and will come out stronger together.

Tyler Lipinski, Mortgage Agent Level 2

647.868.1427 | tyler@vinegroup.ca

555 Bloor St. E., Toronto, ON M4W 1J1

Sources:

https://mortgageproscan.ca/docs/default-source/housing-and-mortgage-marketreview/2023/housing_mortgage_market_review_canada_en_july_2023.pdf?sfvrsn=73dd491_2

https://ycharts.com/indicators/canada_unemployment_rate#:~:text=Canada%20Unemployment%20Rate%20is%20at,long %20term%20average%20of%208.08%25

https://tradingeconomics.com/canada/inflation-cpi

https://www.scotiabank.com/ca/en/about/economics.html

https://economics.td.com/ca-forecast-tables#lt-ca § https://economics.cibccm.com/cds?id=c3bc3599-c315-4573-a952-4b3611022c54&flag=E

https://economics.bmo.com/media/filer_public/e4/f6/e4f6ba18-9b30-4409-8623-f2f7c48ed457/outlookcanada.pdf

Comments